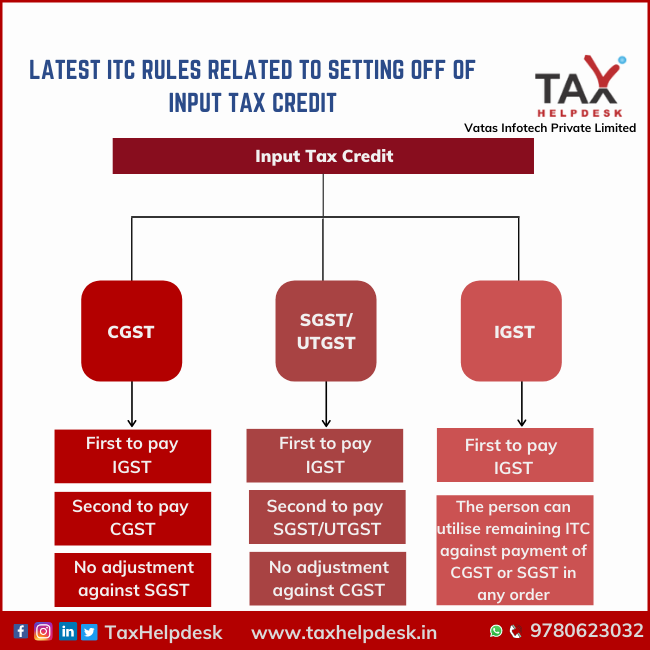

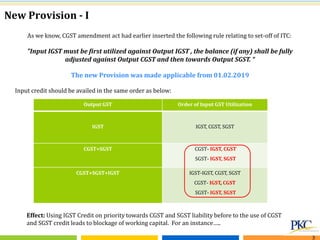

Narnoli & Associates - Chartered Accountants - *Taxpayer need to pay GST from Bank even he have ITC balance from 01.02.2019, Government Amended CGST Act* The government has amended CGST Act 2017

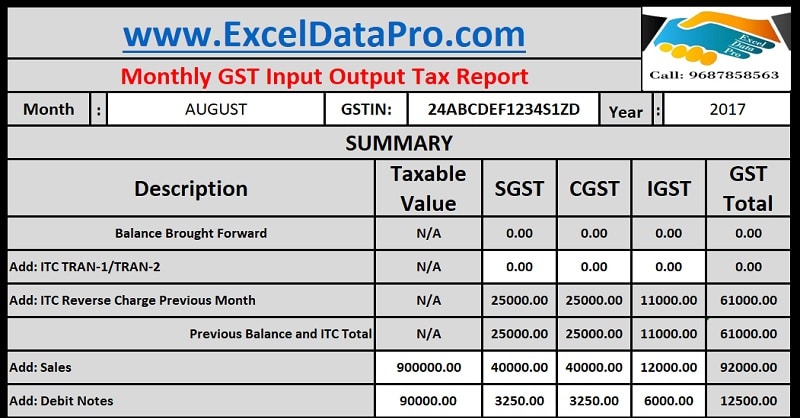

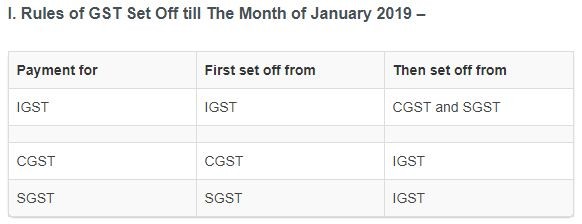

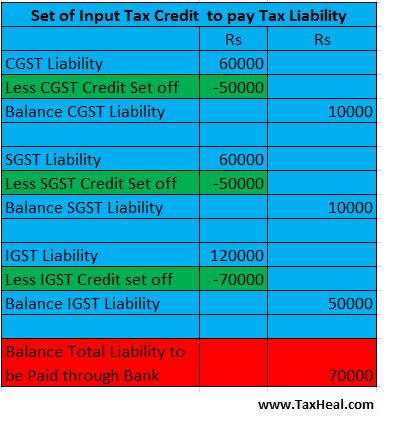

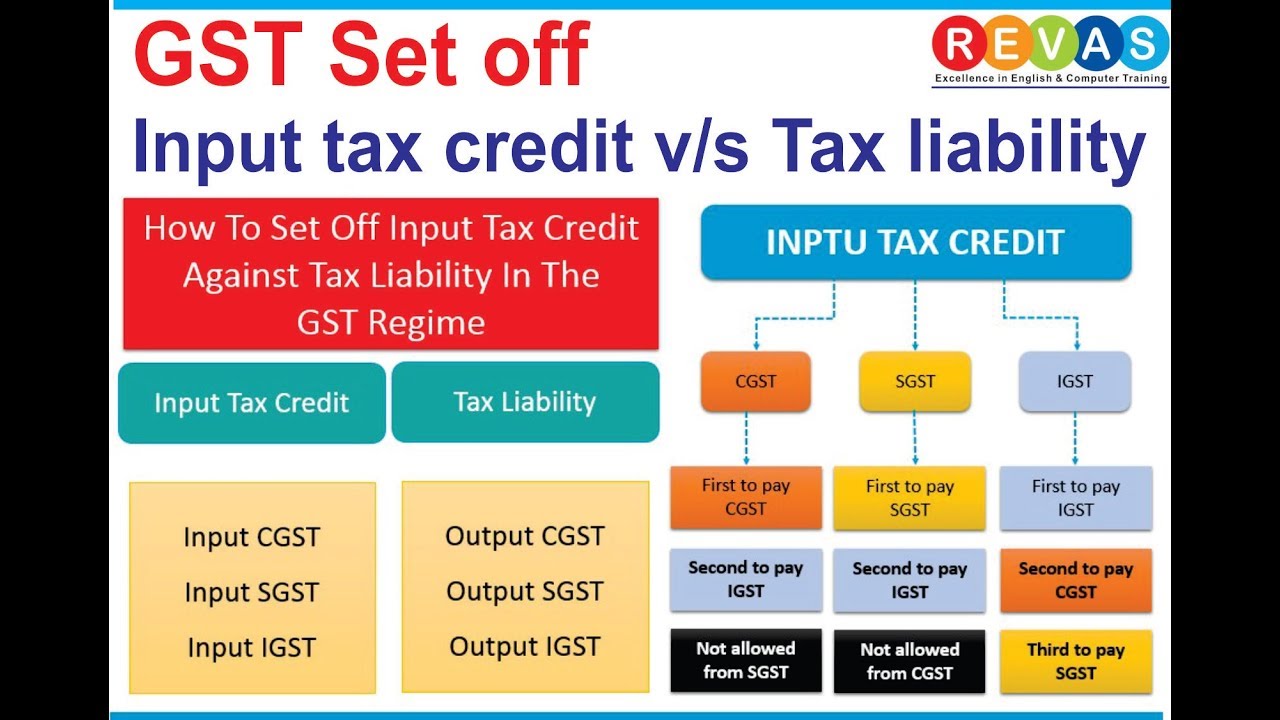

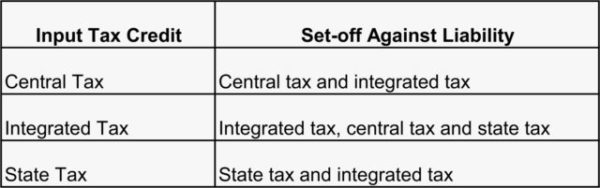

BabaTax - Input Tax Credit (ITC) for payment of GST output Tax liability, e.g IGST can be Set off against IGST and then CGST and SGST, CGST cane be set off against